Back to News

Back to News The electric vehicle (EV) landscape has entered 2026 with renewed energy, marked by major product launches, strategic shifts, and groundbreaking policy developments. The latest updates from manufacturers such as Tesla, Kia, BYD, and Zeekr – alongside broader global shifts in EV policy and infrastructure – reveal both the maturity and the constant transformation of this fast-evolving sector. From Australia to California, the stories shaping the EV world show that the race toward cleaner mobility is no longer just about range or price; it is about redefining what consumers expect from the cars of the future.

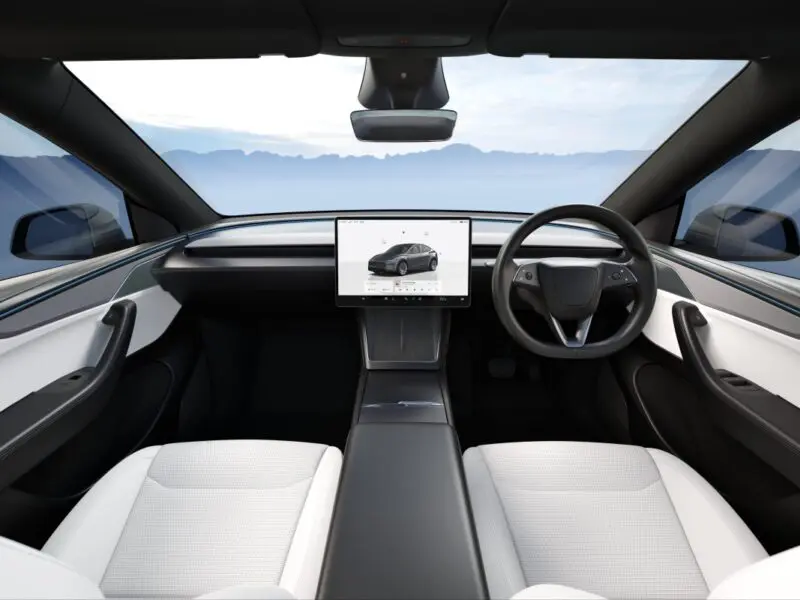

Tesla Leads with an Interior Refresh and a Strategic Rethink

Tesla’s Model Y, already one of the most popular EVs in the world, is being upgraded for the Australian market. The refreshed version brings a larger central display and interior refinements designed to keep customers engaged in a competitive segment. These updates represent Tesla’s continued evolution in human-machine interface design, focusing on comfort and digital experience just as much as engineering efficiency. The move underscores the company’s awareness that even its established models require reinvention to maintain their edge.

In a parallel development, Tesla’s decision to stop selling its Full Self-Driving (FSD) package altogether marks a more profound strategic shift. Instead of one-time purchases, FSD will move to a subscription-only model. This approach transforms the way drivers access autonomous features and signals Tesla’s long-term plan to build a recurring revenue stream. It also hints at the growing complexity of regulatory and technological challenges surrounding autonomous driving. While the company continues to refine its full autonomy vision, the implications for current owners and the wider industry remain significant.

Chinese Brands Gain Ground: Zeekr and GAC Aion Step Forward

The rise of Chinese EV manufacturers continues with Zeekr revealing pricing and specifications for its 7GT model, which undercuts its own 7X SUV in price. Designed as a sleek electric wagon, the 7GT will first enter Europe, marking the brand’s ambition to position itself globally as a style-driven, performance-oriented marque. Its pricing strategy demonstrates how Chinese automakers are leveraging efficient supply chains and technology integration to compete aggressively on both cost and aesthetics.

Similarly, GAC Aion’s confirmation that its Aion UT electric hatchback will arrive in Australia signals the company’s expanding footprint in international markets. Having only recently entered the country, GAC Aion’s rapid rollout of new models shows how global demand for EV diversity is encouraging fresh competition. The UT’s announcement also reflects a growing appetite in Australia for smaller, affordable electric cars suited to urban settings.

Kia and BYD Pursue Opposite Ends of the EV Spectrum

Kia’s updated EV6 points to continued refinement within the mid-to-high-end EV market. The 2026 version brings a slightly larger battery, subtle design enhancements, and a minimal price increase of just $70. This strategy suggests that established automakers are focusing on incremental improvement rather than radical overhaul – betting that reliability, value, and refinement will be key in retaining loyal customers in a crowded space.

At the other end of the price spectrum, BYD’s tiny Atto 1 has made waves by proving that low-cost electric vehicles can feel anything but cheap. Priced within reach of a broader segment of the population, the Atto 1 carries profound symbolic weight: it normalizes EV ownership for those previously excluded by high entry prices. As the brand garners attention in Australia and other regions, it challenges the long-standing assumption that sustainable mobility must come at a premium.

Technology, Infrastructure, and Policy: The Wider Context

Beyond the vehicle announcements, the broader EV ecosystem is also shifting rapidly. In California, a new $200 million incentive program for zero-emission vehicles aims to counter federal rollbacks on clean energy support. This initiative serves as a reminder that policy will remain one of the most powerful tools for accelerating electrification – particularly in markets where political and industrial forces pull in different directions.

Meanwhile, updated crash test data has revealed that electric cars now dominate the safety leaderboard in Australia, with six of the seven highest-rated vehicles being EVs. This finding underscores one of the less-discussed advantages of battery-powered architecture: inherent crash resilience due to low centers of gravity and reinforced battery structures. Safety, once a question mark for early adopters, is fast becoming a selling point.

Complementing these developments is the emergence of new accessories and charging solutions designed for practical flexibility. One review focused on the MSI EZgo portable EV charger, exploring whether an upgrade to a portable solution is worth the expense compared to basic included chargers. Such innovations highlight the growing sophistication of the support ecosystem around EV ownership—mobility is no longer only about the car itself but the infrastructure that surrounds it.

The Decline of Hydrogen and the Consolidation of the Electric Future

The latest data from Europe shows a sharp decline in hydrogen refueling stations as battery-electric vehicles dominate sales and infrastructure investment. Hydrogen’s once-heralded promise for passenger cars appears increasingly limited as automakers, governments, and consumers coalesce around battery solutions. The momentum is clear: battery-electric vehicles are now the default path for decarbonizing road transport.

A Year of Maturity and Movement

Taken together, these developments from around the globe paint a compelling portrait of an industry that has matured beyond novelty. Automakers are refining instead of reinventing, new entrants are expanding into established markets, and policy landscapes are recalibrating around sustainability. The decade’s second half may finally fulfill the EV revolution’s early promises: innovation not just at the cutting edge, but at the center of everyday mobility.

All EV Sales Research Team

1/17/2026